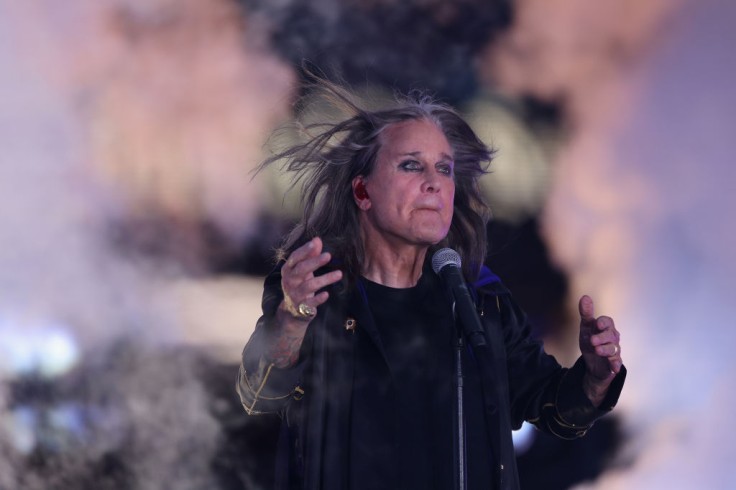

Ozzy Osbourne's family faces the prospect of losing tens of millions of dollars after the rock star's death exposed his estate to substantial tax liabilities on both sides of the Atlantic, legal and tax experts say.

According to RealEstate.com, the Black Sabbath frontman, who maintained residences in the United Kingdom and the United States, left behind a global estate that includes a Los Angeles home in Hancock Park and a countryside property in Buckinghamshire.

The cross-border nature of his assets could subject the estate to U.S. federal estate tax and U.K. inheritance tax, potentially eroding a significant portion of the fortune his widow, Sharon Osbourne, and their children expect to inherit.

As per CNBC, U.S. federal estate tax applies to estates that go over the current exemption limit. This limit has changed over the years, and Congress can adjust it. Estates valued over the exemption limit may face tax rates that significantly decrease the net assets heirs can inherit. In the U.K., inheritance tax can reach 40% on assets that go beyond the nil-rate band, after considering any reliefs and exemptions that apply.

Estate planning specialists warned that the complexity of Ozzy Osbourne's holdings — including intellectual property, royalties, music rights, and real estate across multiple jurisdictions — will make the probate process lengthy and may invite scrutiny from tax authorities in both countries.

"If even one of Ozzy's older children feels left out or short-changed, it could trigger a full legal challenge," said Adam Jones, a family legal specialist.

Sharon Osbourne, 73, is named, according to Economic Times, among those expected to inherit a large share of the estate, which industry sources estimate to be in the hundreds of millions of dollars. Ozzy's children — Jessica, Elliot, Aimee, Kelly, Jack and Louis — are also set to receive portions. The presence of younger and older children from different relationships, plus the use of intellectual property, raises the possibility of litigation if any beneficiaries believe the distribution is unfair.

A legal insider close to the family said professionals are working on mitigating exposure, but cautioned there are few simple solutions once a high-value estate spans multiple legal systems. "The Osbournes are up against two completely different tax systems and legal processes at once. It's a logistical and financial nightmare," the source said. "Even with top experts handling it, the potential losses could be huge."

Some experts suggested that if Ozzy's assets were held in trusts or if specific succession instruments were established before his death, the family might limit both tax exposure and public probate proceedings. Trusts can, in some cases, streamline distribution and protect certain assets from probate; however, their effectiveness depends on timing, structure and the jurisdictions involved.

The Osbourne family has previously signaled a desire to protect Ozzy's legacy and retain control over use of his name and likeness. Sharon has publicly asserted that she wants the family to maintain ownership of his intellectual property to prevent outsiders from exploiting it for commercial gain.

Tax attorneys note that inheritance disputes often arise when high-profile estates combine substantial intangible assets with multiple heirs.

Representatives for the Osbourne family did not immediately respond to requests for comment. Tax authorities in the U.S. and U.K. do not confirm investigations or assessments publicly in ongoing matters.

© 2026 MusicTimes.com All rights reserved. Do not reproduce without permission.